10 Secrets About Shopify You Can Learn From Tv

Invoice Generator Things To Know Before You Get This

Table of ContentsHow Detailed Invoice can Save You Time, Stress, and Money.7 Easy Facts About Invoice Maker DescribedThe 9-Second Trick For Invoice GeneratorThe 2-Minute Rule for Invoicing FeaturesAbout Detailed Invoice

The Only Guide for Invoice Generator

The Only Guide for Invoice Generator

https://www.youtube.com/embed/Oy5KVL-gCl0

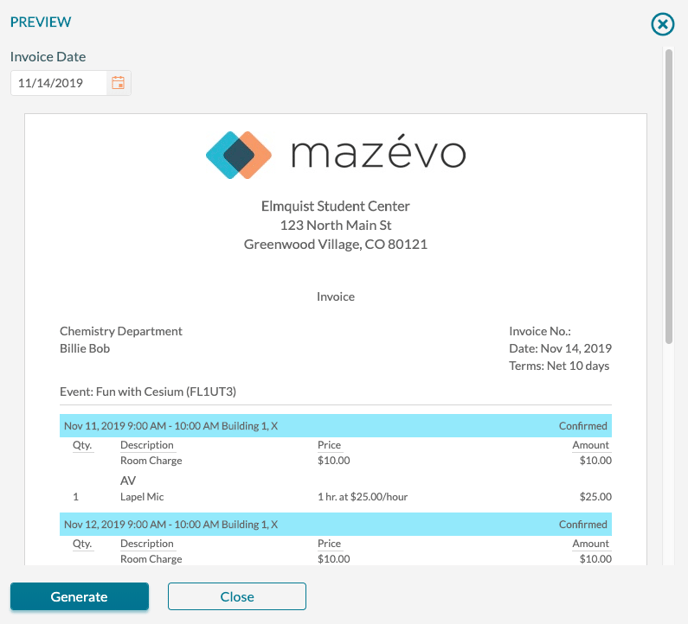

Billings can be deleted at any time! Here's how: Click the billing to view it. As soon as the invoice is open, you'll see 3 buttons at the top of the screen: and, as revealed below. Click. Deleted invoices and other erased files can not be recovered. Ensure to download the document as a PDF prior to deleting if you wish to keep it for your records.

They can remain in the system to suggest you have actually billed the client. If invoices aren't developed for a session, the session cost will not become part of the client's balance and payments will result in a credit balance. Yes, in order to utilize the billing features of SimplePractice, you'll require to utilize billings.

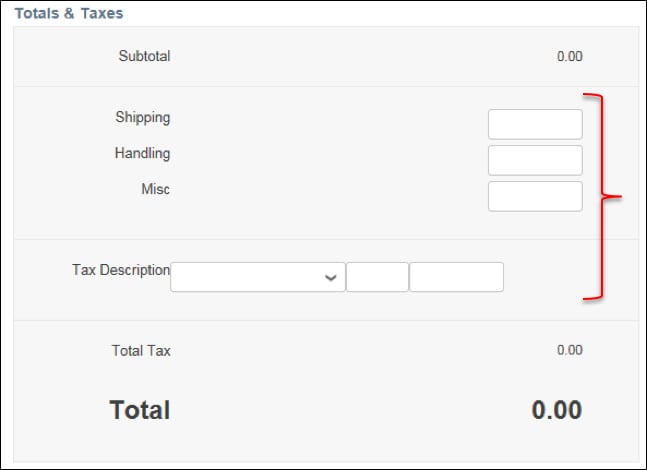

Lots of SimplePractice consumers want to add sales tax to their invoices. While this is something that our program can not currently determine automatically, you can develop a Sales Tax "Product" which can be added to any invoice. Initially, go to and add a brand-new item for Sales Tax with a description that works for you.

How Invoice Generator can Save You Time, Stress, and Money.

Now go back to your customer's profile and create an Invoice. Click to customize the billing and the button to enter your sales tax line product. Click to include the Sales Tax Product you developed. Then click to go back to the invoice. Next, determine and enter the appropriate amount of the sales tax based upon the cost in the filed and click at the top of the billing.

Some consumers choose to pass along the credit card processing charges to their customers. In some states this practice is illegal, so confirm the laws that govern card approval in your state prior to you include fees to your credit billings. Here is how to include the processing charge to a client billing: That's it! Now your billing includes a credit card processing fee.

You can access and make a copy of it from here: Consumers often ask us for guidance about the legality of this practice (i. e., passing credit card charges on to clients). The best method to get an answer to this concern is to ask an attorney. Nevertheless, we can offer some information pdf that is extensively offered on this problem.

Indicators on Mobile Invoice Maker App You Should Know

Please note that this is general information just and we do not intend for you to use any of it as legal recommendations or guidance. Nor do we intend for you to utilize it in lieu of looking for proper legal counsel. If you set the client's visit charge incorrectly or you choose to alter the fee for your customer, you may require to delete and recreate billings for these consultations.

The invoice will display $100 due for the appointment. However, what if you suggested to charge the customer $80 for this visit? If you edit the consultation charge and change it to $80, the billing will not automatically change to $100. The system believes you are making a modification so it develops a modification billing with a $20 credit.

These additional billings can be puzzling if you didn't suggest to expense that method. Let's stroll through the correct steps, which will leave you with a cleaner billing page. For the visit that isn't billed correctly you can pick one of two options:. You are correcting the billing since it reveals the incorrect fee and you only plan to bill the client $80 (this is the most typical scenario): Browse to the customer's billing summary page, and click the billing listed beside the appointment in the consultation line and click in the top right corner.

The 9-Second Trick For Invoice Generator

Click under the visit fee. Update the visit cost (from $100 to $80). Click. Then develop a brand-new invoice for the customer. You want to produce a change billing and you don't wish to delete the original billing. In this case, you can modify the consultation fee and let the system create the adjustment invoice.

Click under the consultation charge. Enter the updated appointment cost and click. The system will instantly produce a modification invoice. If you have actually billings set to be developed instantly, this modification billing will be produced overnight. Otherwise, you can produce it manually by clicking from the upper right corner of the customer's profile.

We advise keeping billings automation on Daily in order to avoid any billing confusion. Simply make sure to make any session charge modifications prior to the end of the day so invoices generate correctly.

Indicators on Invoicing Features You Should Know

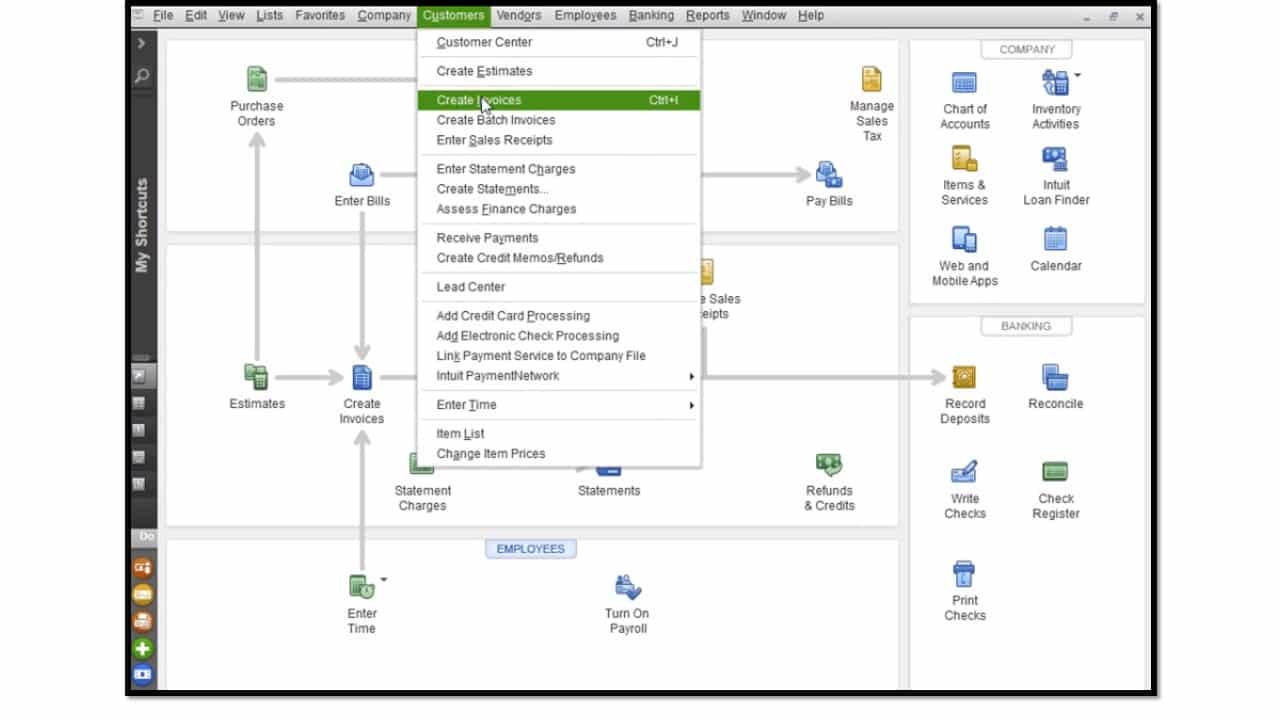

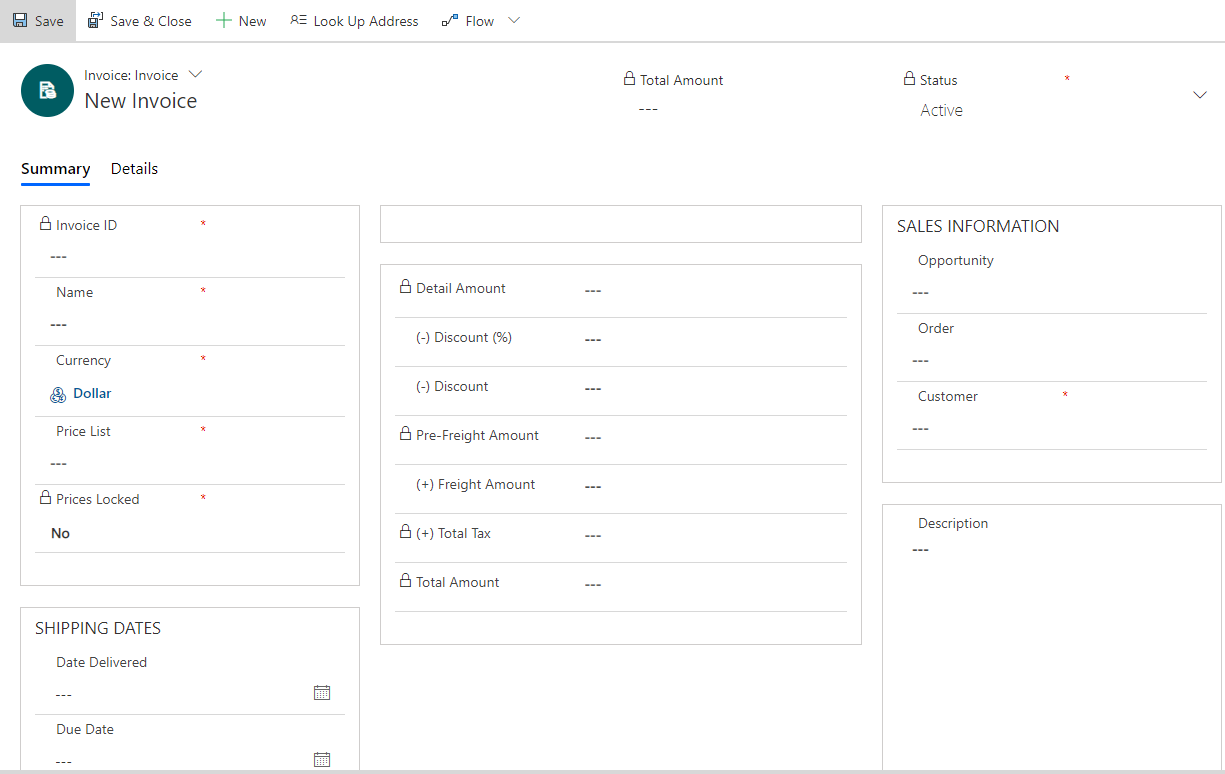

You've done the work; now it's payment time. Here's where your billing plays an essential role. Let's walk through the process of making a billing. Prior to drawing up an invoice, ensure your client is anticipating one. If your billing comes out of nowhere, they might be sluggish to pay it, or even upset.

If you don't have an arrangement in place, at least tell them when a billing will be raised. You require to reveal the seller, the purchaser, and what was exchanged. You may likewise be required to show if you collected tax on the sale. A few of the details, such as your business name, will remain the same from one billing to the next.

8 Simple Techniques For Invoice Generator

8 Simple Techniques For Invoice Generator

You need to have a distinct invoice number on every costs you send. This is to help you, the client, or potentially auditors to find specific invoices. An invoice number can be any string of numbers and letters. You can utilize different approaches to develop an invoice number, such as: numbering your invoices sequentially, for example INV00001, INV00002 beginning with an unique consumer code, for example XER00001 including the date at the start of your invoice number, for example 2019-01-001 integrating the client code and date, for example XER-2019-01-001 Your numbering system can assist you arrange and look for previous billings rapidly.

10 Tell-tale Signs You Need To Get A New Customer

Things about Detailed Invoice

Table of ContentsTypes Of Invoices - An OverviewThe smart Trick of Invoicing Features That Nobody is DiscussingExcitement About Invoice MakerGetting My Invoice Maker To Work9 Easy Facts About Invoice Generator Explained

The Greatest Guide To Invoicing Features

The Greatest Guide To Invoicing Features

https://www.youtube.com/embed/81kBQ92hXwU

Invoices can be erased at any time! Here's how: Click the billing to see it. Once the billing is open, you'll see 3 buttons at the top of the screen: and, as revealed below. Click. Deleted invoices and other erased files can not be retrieved. Make certain to download the document as a PDF prior to erasing if you wish to keep it for your records.

They can stay in the system to show you have actually billed the client. If invoices aren't produced for a session, the session charge will not become part of the customer's balance and payments will result in a credit balance. Yes, in order to use the billing features of SimplePractice, you'll require to utilize billings.

Many SimplePractice clients wish to include sales tax to their invoices. While this is something that our program can not presently determine instantly, you can develop a Sales Tax "Product" which can be added to any billing. First, go to and add a brand-new product for Sales Tax with a description that smartphone works for you.

How Invoice Maker can Save You Time, Stress, and Money.

Now go back to your client's profile and produce an Invoice. Click to customize the invoice and the button to enter your sales tax line product. Click to include the Sales Tax Item you developed. Then click to return to the invoice. Next, compute and go into the proper amount of the sales tax based upon the charge in the filed and click at the top of the billing.

Some consumers decide to pass along the charge card processing charges to their customers. In some states this practice is illegal, so verify the laws that govern card acceptance in your state before you add fees to your credit invoices. Here is how to include the processing cost to a customer billing: That's it! Now your billing includes a charge card processing cost.

You can access and make a copy of it from here: Clients typically ask us for suggestions about the legality of this practice (i. e., passing charge card charges on to customers). The very best way to get an answer to this question is to ask a legal representative. However, we can offer some information that is commonly offered on this concern.

Rumored Buzz on Invoice Generator

Please note that this is general details only and we do not mean for you to use any of it as legal suggestions or assistance. Nor do we intend for you to use it in lieu of looking for appropriate legal counsel. If you set the client's appointment cost improperly or you choose to alter the charge for your client, you might require to erase and recreate billings for these appointments.

The billing will display $100 due for the consultation. However, what if you meant to charge the client $80 for this consultation? If you modify the consultation cost and alter it to $80, the invoice won't instantly alter to $100. The system believes you are making a change so it produces an adjustment billing with a $20 credit.

These extra billings can be confusing if you didn't imply to bill that way. Let's walk through the right steps, which will leave you with a cleaner billing page. For the visit that isn't billed properly you can pick one of 2 options:. You are remedying the billing because it shows the inaccurate fee and you only plan to bill the customer $80 (this is the most common situation): Browse to the client's billing introduction page, and click the billing noted beside the appointment in the visit line and click in the top right corner.

Invoicing Features Things To Know Before You Get This

Click under the visit cost. Update the consultation charge (from $100 to $80). Click. Then develop a brand-new billing for the client. You wish to create a change invoice and you do not desire to delete the initial invoice. In this case, you can edit the appointment cost and let the system produce the adjustment invoice.

Click under the appointment charge. Go into the updated appointment charge and click. The system will instantly produce an adjustment invoice. If you have actually invoices set to be created immediately, this change billing will be created overnight. Otherwise, you can produce it manually by clicking from the upper right corner of the customer's profile.

We advise keeping billings automation on Daily in order to avoid any billing confusion. Simply make certain to make any session fee changes before completion of the day so billings produce properly.

Facts About Create Invoices Uncovered

You have actually done the work; now it's payment time. Here's where your invoice plays a key function. Let's walk through the procedure of making an invoice. Prior to preparing an invoice, make certain your client is expecting one. If your billing comes out of nowhere, they might be slow to pay it, or perhaps upset.

If you don't have an agreement in location, at least inform them when an invoice will be raised. You require to reveal the seller, the purchaser, and what was exchanged. You might likewise be needed to reveal if you gathered tax on the sale. Some of the details, such as your service name, will remain the same from one invoice to the next.

The Single Strategy To Use For Invoicing Features

The Single Strategy To Use For Invoicing Features

You require to have an unique invoice number on every costs you send out. This is to help you, the consumer, or potentially auditors to find specific billings. An invoice number can be any string of numbers and letters. You can use various methods to produce a billing number, such as: numbering your billings sequentially, for example INV00001, INV00002 starting with a special client code, for instance XER00001 including the date at the start of your invoice number, for instance 2019-01-001 integrating the client code and date, for example XER-2019-01-001 Your numbering system can help you organize and search for previous billings rapidly.

5 Laws That'll Help The Spark Invoice Maker Industry

Invoice Maker Can Be Fun For Everyone

Table of ContentsThe Buzz on Invoice GeneratorThe smart Trick of Detailed Invoice That Nobody is Talking AboutIndicators on Invoicing Features You Should KnowThe Of Types Of InvoicesThe Create Invoices Ideas

Not known Factual Statements About Types Of Invoices

Not known Factual Statements About Types Of Invoices

https://www.youtube.com/embed/1WU_YWv3Fq0

Billings can be erased at any time! Here's how: Click the billing to see it. As soon as the invoice is open, you'll see 3 buttons at Spark Invoice Maker the top of the screen: and, as revealed listed below. Click. Deleted invoices and other erased documents can not be retrieved. Ensure to download the file as a PDF prior to erasing if you want to keep it for your records.

They can remain in the system to suggest you have actually billed the client. If billings aren't developed for a session, the session cost will not be part of the customer's balance and payments will lead to a credit balance. Yes, in order to use the billing features of SimplePractice, you'll need to use billings.

Numerous SimplePractice customers want to add sales tax to their invoices. While this is something that our program can not currently calculate instantly, you can produce a Sales Tax "Item" which can be included to any billing. Initially, go to and add a brand-new item for Sales Tax with a description that works for you.

Little Known Questions About Invoice Maker.

Now go back to your customer's profile and produce an Invoice. Click to tailor the invoice and the button to enter your sales tax line product. Click to consist of the Sales Tax Item you created. Then click to go back to the invoice. Next, determine and go into the suitable amount of the sales tax based upon the cost in the filed and click at the top of the billing.

Some consumers choose to pass along the credit card processing costs to their clients. In some states this practice is unlawful, so validate the laws that govern card acceptance in your state prior to you add fees to your credit invoices. Here is how to add the processing cost to a customer invoice: That's it! Now your billing includes a credit card processing cost.

You can access and make a copy of it from here: Consumers often ask us for recommendations about the legality of this practice (i. e., passing charge card costs on to clients). The very best way to get an answer to this question is to ask a lawyer. However, we can supply some details that is widely offered on this problem.

Mobile Invoice Maker App Things To Know Before You Buy

Please keep in mind that this is basic info just and we do not plan for you to utilize any of it as legal recommendations or guidance. Nor do we mean for you to use it in lieu of seeking appropriate legal counsel. If you set the client's consultation fee incorrectly or you decide to change the fee for your client, you may need to delete and recreate billings for these visits.

The invoice will show $100 due for the visit. But, what if you meant to charge the client $80 for this visit? If you edit the consultation fee and alter it to $80, the invoice will not automatically change to $100. The system believes you are making a modification so it produces a change invoice with a $20 credit.

These extra billings can be puzzling if you didn't suggest to expense that way. Let's walk through the right steps, which will leave you with a cleaner billing page. For the visit that isn't billed correctly you can select one of 2 options:. You are fixing the billing because it shows the incorrect cost and you just plan to bill the customer $80 (this is the most typical situation): Browse to the customer's billing overview page, and click the billing noted beside the consultation in the appointment line and click in the leading right corner.

Detailed Invoice Can Be Fun For Anyone

Click under the visit fee. Update the consultation cost (from $100 to $80). Click. Then produce a brand-new billing for the customer. You wish to create an adjustment billing and you don't desire to delete the initial billing. In this case, you can modify the appointment cost and let the system create the change billing.

Click under the consultation cost. Go into the upgraded appointment charge and click. The system will automatically create a change billing. If you have actually billings set to be produced immediately, this change billing will be generated overnight. Otherwise, you can produce it manually by clicking from the upper right corner of the client's profile.

We suggest keeping billings automation on Daily in order to prevent any billing confusion. Just make sure to make any session cost changes before the end of the day so billings generate properly.

Invoice Maker Fundamentals Explained

You've done the work; now it's payment time. Here's where your invoice plays a key role. Let's walk through the process of making an invoice. Prior to drawing up an invoice, make sure your customer is expecting one. If your billing comes out of nowhere, they may be slow to pay it, or even irritated.

If you do not have an arrangement in location, a minimum of inform them when a billing is about to be raised. You require to show the seller, the buyer, and what was exchanged. You may also be required to show if you collected tax on the sale. A few of the information, such as your business name, will remain the same from one invoice to the next.

The Only Guide to Invoice Maker

The Only Guide to Invoice Maker

You require to have a special invoice number on every costs you send. This is to help you, the client, or potentially auditors to find specific invoices. A billing number can be any string of numbers and letters. You can utilize different approaches to create a billing number, such as: numbering your billings sequentially, for instance INV00001, INV00002 starting with a special customer code, for instance XER00001 consisting of the date at the start of your billing number, for example 2019-01-001 combining the customer code and date, for instance XER-2019-01-001 Your numbering system can help you organize and browse for past billings rapidly.

No Time? No Money? No Problem! How You Can Get Snail Mail With A Zero-dollar Budget

The 10-Second Trick For Invoicing Features

Table of ContentsThe smart Trick of Invoice Maker That Nobody is Talking AboutNot known Facts About Types Of InvoicesThe Only Guide for Invoicing Features7 Simple Techniques For Invoice GeneratorSome Ideas on Types Of Invoices You Need To Know

Some Ideas on Types Of Invoices You Need To Know

Some Ideas on Types Of Invoices You Need To Know

https://www.youtube.com/embed/wm48OWObU_4

Billings can be erased at any time! Here's how: Click the billing to see it. As soon as the invoice is open, you'll see 3 buttons at the top of the screen: and, as shown listed below. Click. Deleted invoices and other erased files can not be recovered. Ensure to download the document as a PDF prior to deleting if you want to keep it for your records.

They can remain in the system to suggest you have actually billed the client. If billings aren't developed for a session, the session cost will not be part of the client's balance and payments will result in a credit balance. Yes, in order to utilize the billing functions of SimplePractice, you'll require to utilize invoices.

Many SimplePractice customers would like to include sales tax to their billings. While this is something that our program can not currently calculate immediately, you can create a Sales Tax "Product" which can be included to any invoice. First, go to and include a brand-new product for Sales Tax with a description that works for you.

9 Easy Facts About Detailed Invoice Described

Now go back to your customer's profile and develop an Invoice. Click to customize the billing and the button to enter your sales tax line product. Click to consist of the Sales Tax Product you created. Then click to return to the billing. Next, calculate and enter the appropriate amount of the sales tax based on the fee in the submitted and click at the top of the billing.

Some clients choose to pass along the credit card processing costs to their customers. In some states this practice is prohibited, so validate the laws that govern card acceptance in your state prior to you add costs to your credit invoices. Here is how to include the processing charge to a customer invoice: That's it! Now your billing consists of a credit card processing cost.

You can access and make a copy of it from here: Customers typically ask us for advice about the legality of this practice (i. e., passing charge card fees on to customers). The very best method to get an answer to this concern is to ask a legal representative. Nevertheless, we can provide some info that is commonly available on this issue.

About Invoicing Features

Please keep in mind that this is general information just and we do not intend for you to utilize any of it as legal recommendations or assistance. Nor do we plan for you to use it in lieu of looking for proper legal counsel. If you set the customer's appointment charge incorrectly or you choose to change the charge for your customer, you might require to erase and recreate billings for these appointments.

The billing will show $100 due for the appointment. But, what if you suggested to charge the customer $80 for this consultation? If you edit the appointment cost and Spark Invoice Maker alter it to $80, the billing will not immediately change to $100. The system believes you are making a modification so it develops a change invoice with a $20 credit.

These extra billings can be confusing if you didn't suggest to bill that method. Let's walk through the correct steps, which will leave you with a cleaner billing page. For the appointment that isn't billed correctly you can pick one of 2 choices:. You are fixing the billing since it reveals the inaccurate fee and you just plan to bill the customer $80 (this is the most common circumstance): Navigate to the client's billing introduction page, and click the invoice listed beside the consultation in the consultation line and click in the top right corner.

The Definitive Guide to Create Invoices

Click under the visit cost. Update the consultation charge (from $100 to $80). Click. Then create a brand-new invoice for the customer. You desire to produce a modification billing and you don't desire to erase the original billing. In this case, you can edit the appointment fee and let the system produce the modification billing.

Click under the appointment cost. Enter the upgraded consultation charge and click. The system will automatically produce a change invoice. If you have actually billings set to be produced instantly, this modification invoice will be created over night. Otherwise, you can develop it manually by clicking from the upper right corner of the client's profile.

We suggest keeping invoices automation on Daily in order to prevent any billing confusion. Simply make sure to make any session charge modifications prior to completion of the day so invoices generate properly.

What Does Mobile Invoice Maker App Mean?

You have actually done the work; now it's payment time. Here's where your billing plays a crucial role. Let's stroll through the process of making an invoice. Before drawing up a billing, ensure your client is anticipating one. If your billing comes out of no place, they may be slow to pay it, or perhaps annoyed.

If you don't have a contract in place, at least tell them when an invoice is about to be raised. You need to reveal the seller, the buyer, and what was exchanged. You may also be required to show if you collected tax on the sale. A few of the details, such as your company name, will stay the very same from one billing to the next.

All About Invoice Generator

All About Invoice Generator

You need to have a distinct invoice number on every costs you send out. This is to assist you, the client, or possibly auditors to locate specific billings. A billing number can be any string of numbers and letters. You can use various techniques to produce a billing number, such as: numbering your billings sequentially, for instance INV00001, INV00002 beginning with an unique customer code, for example XER00001 consisting of the date at the start of your billing number, for instance 2019-01-001 integrating the customer code and date, for example XER-2019-01-001 Your numbering system can assist you arrange and search for previous invoices quickly.